If you have the right resources, keeping track of company expenditures and sales becomes a lot easier. These resources will assist you in keeping track of your sales, expenditures and regular activities. As a small business owner, this will allow you to keep a closer eye on every incoming and outgoing. Moreover, improved cost management would improve profitability.

Tracking your company expenses makes tax time a lot easier because many of them can be written off. You’re more likely to miss future deductions if you keep track of your spending on a daily basis. As a result, you’ll pay less in taxes (or get more back).

Let’s discuss some of the strategies to track your daily sales and expenses:

Open Business Financial Accounts

The distinction between personal and company finances can be fuzzy for freelancers and small businesses. When the tax is due, you may find yourself looking for expenses among your grocery and clothing purchases.

Open company financial statements to keep track of all business-related expenditures. Then, for all company transactions, use your business accounts.

You’ll need:

- A business chequing account

- A business savings account

- A business credit card

It’s also a good idea to place your company expenses on a rewards credit card. On some credit cards, you can get cash back on your transactions. Others allow you to accumulate points and use them to book flights and hotels. Forbes has assembled a list of the best business credit cards available.

Where possible, entrepreneurs advise against using cash. Cash is too easy to spend, difficult to monitor, and only has a receipt as a backup, while a digital transaction leaves a record in your bank account as well as a receipt. Using debit and credit for transactions is better for your company, better at tax time, and certainly better if you get audited.

Store Invoices Properly

Paper Receipts

Here are some tips for keeping a proper record of paper receipts:

Keep business paper receipts in a separate envelope in your purse or wallet. If you can’t stick to filing your receipts on a regular basis, set aside time once a week to do so. One option is to do it on a Friday afternoon, and make it a recurring appointment on your calendar.

Use file folders

Create one for each month at the start of the year and file your receipts accordingly. Use a filing cabinet or an accordion folder to organise your documents.

Use binders: Purchase plastic sleeves and mark them according to the month or type. If you have a lot of receipts, categorising them can make things simpler when it comes time to file your taxes.

Don’t forget to write the reason for your purchase on your receipts. Unless you write down that a $10 sandwich was purchased during a lunch with a particular client, a receipt from six months ago won’t tell you anything.

Receipts In Digital Format

There are multiple applications that make it easier to store receipts digitally. Plus, if you scan your receipts, you won’t need paper backups.

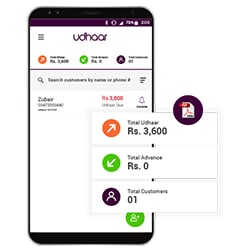

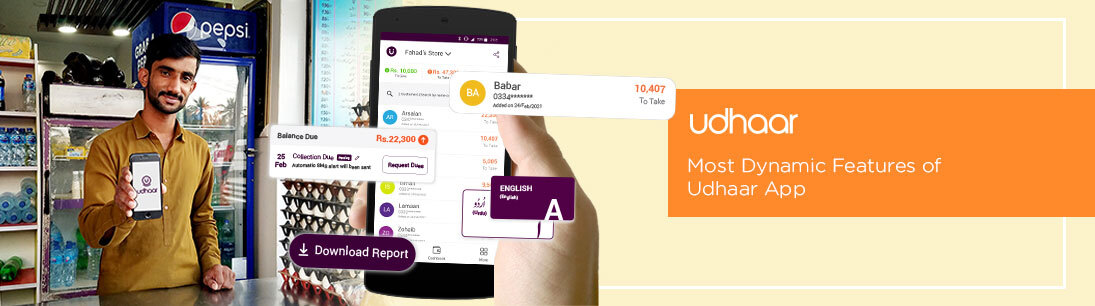

Udhaar App has a feature that allows you to conveniently create receipts and send them to your customers to receive your payment quickly.

You can also manage your daily sales, cash, expenses and send free invoices to your customers. Udhaar Bill Book simplifies the job of a bookkeeper. No need to calculate your daily sales cash balance manually. It will help you reconcile transactions easily.