- Non-Telenor mobile phone customers can register by texting ‘EPspace>CNIC number’ to 0345-111-3737.

- Wait for a call from an Easypaisa representative who will verify your information.

- You’ll be prompted to establish a 5-digit pin code when you’ve been verified.

- Now type a PIN, followed by a space, followed by a 5-digit pin code, followed by a space.

- Send the 5-digit pin code to 0345-1113737 after you’ve double-checked it.

- Remember to input the pin code you generated in the previous message.

- A user will receive a confirmation SMS from 3737 after sending the message. The notification will inform them that their Easypaisa account has been successfully activated.

How to open an Easy Paisa bank account?

- Easypaisa has a mobile app that you may download.

- Launch the app after it has been successfully installed.

- Please enter your phone number.

- Enter your CNIC number and the date it was issued.

- For account creation, create a 5-digit pin code.

- Non-Telenor customers can also sign up for Easypaisa by texting their phone number to 0345-1113737. EPspace>CNIC number and send it to 0345-1113737 is the technique for sending the message.

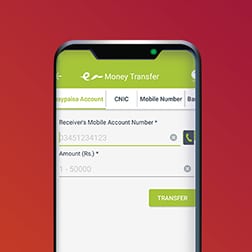

How to Get Money Via a ‘Money Transfer’

If a friend or family member has sent you money by ‘Money transfer,’ then follow the steps below to collect it.

Before going to an Easy Paisa outlet, make sure you have the following items.

- 1 photocopy of the original and valid Nadra CNIC (Mandatory)

- The sender has provided you with a Transaction ID (Mandatory)

- You have been given a passcode by the sender (Mandatory)

Once you have these items, go to any authorized Easy Paisa location and complete the steps below.

- Provide your Transaction ID to the store.

- Give him/her the original and photocopy of your CNIC, and when he/she asks, input the passcode on the retailer’s phone. Take the money – and that’s it.

Important Note: Expired Nadra CNICs will not be accepted for Money Transfer operations, either sending or receiving.

How to Use Easy Paisa ‘Money Transfer’ to Send/Receive Money

To send money via ‘Money Transfer,’ click here.

For a Money Transfer, the Sender must present and supply the following:

- 1 photocopy of his/her original and valid Nadra CNIC (Mandatory)

- Obtaining the recipient’s legitimate Nadra CNIC Number (Mandatory)

- His or her own (optional) mobile phone number, as well as the receiver’s cell phone number (Optional)

- If you have the three items listed above, simply head to any authorized Easy Paisa outlet and complete the steps below.

- Tell the retailer how much money you have and provide the three items listed above.

- The retailer will complete the transaction using his or her mobile phone (similar to easy share), and you will be required to enter a passcode or secret code. This secret code should not be shared with anyone.

- You will be provided a Transaction ID and a physical copy of the receipt once the transaction is completed.

- Pay the money to the retailer plus service fees (chart about service charges is given below)

- Both the Sender and the Receiver will be able to receive transaction details by SMS message if the Sender and Receiver’s mobile phone numbers are provided. Only the transaction ID, amount, and CNIC numbers will be sent to you through SMS.

Important: Please do not throw away or throw away the receipt, as it will be your sole proof that you sent the money. Also, the Passcode should not be shared with anyone.

Give the receiving party the Transaction ID and passcode you inputted, and that’s it. You’ve finished sending money.

How can Small – Medium Enterprises benefit from Udhaar Book?

Gateway for online payments

Scale swiftly with our cutting-edge online payment solution, and let your consumers choose from a range of payment choices, including mobile wallets and credit/debit cards, to pay you.

Payments for Business and Salaries

Pay your employees and business partners according to their preferences.

Payments Made in-Store

QR payments not only eliminate cash from in-store transactions but also allow for real-time fund settlement. It will be a cost of physically handling currency that is secure and safe.

Convenient Cash Management

Customers can pay using a variety of channels, including mobile wallets and Easypaisa shops, 24 hours a day, seven days a week.

Udhaar App – Digital Khata, Udhaar Khata Book – Frequently Asked Questions

What is Udhaar?

A money management application that keeps track of all of your transactions, including withdrawals and deposits.

Who can use the Udhaar app?

Anyone who manages money or does not complete transactions instantly can utilize the Udhaar app. Retail, wholesale, manufacturing, bakery/dairy, pharmacy, and hardware stores all make great use of our khata book. The list goes on, implying that there are no limits to who can make use of it.

How Secure is the Udhaar app?

Because all data is stored in the cloud, there is complete security. Employees are unable to read or copy the same data.

How is Udhaar beneficial for businesses?

The Udhaar app is user-friendly and simple to use, with numerous functions such as reporting and a quick response time. A new transaction can be created in a matter of seconds.

Where can I get Udhaar App from?

Download the App from Google Playstore Click Here

Download the App from Apple App Store Click Here

Download the direct APK file Click Here

What Small Businesses Can Use A Digital Udhaar App?

Following the numerous advantages that a digital Udhaar app may provide, every small company owner will be eager to download and use the app in order to obtain the full benefits of their business. Also, If you’re still not sure if this app is perfect for you, here’s a list of businesses who can benefit from it:

-Electronic shops including mobile recharging shops.

-Grocery and general stores

-Bakery, juice sellers, medical shops, vegetable shops, tea shops, etc

-Stores that sell Jewelry or garment stores

Don’t worry if your store or shop isn’t featured; any business looking to store a safe, secure, and smooth transaction record with clients can benefit from the Udhaar app’s features.

The application not only benefits small business owners, but also homemakers who may use it to keep track of their water can supplier, maid, and other service providers. Making it easy to keep track of daily transactions using your smartphone rather than just your memory.

3 Reasons Why Every Small Business Should Use Digital Khata

Digital Khata: 3 Reason why every small business is using this

Cost-effective

Our Udhaar app or khata book is a free digital ledger that you can take with you wherever you go. The application helps you calculate all your invoices and customer transactions. The best thing about it is that one application can manage multiple business transactions in your store, which means you can use the same digital khata account on different phones through the udhaar app.

Simplified System

The application does all the hard work for you, so you won’t need to get your head around accounting anymore, let the Udhaar app do the job for you.

Reliable and Scalable

You can even set payment reminders on an individual basis for each customer, so you don’t have to run through your head or flip through your pages to find past transactions. The Udhaar app has been developed to ensure stability and it’s our goal to release timely updates as we develop new app features. You won’t need to worry about losing any data or scaling up – with the Udhaar app, everything stays saved in real-time on the cloud!

What is a Khata or Udhaar (accounting) Book?

A Udhaar or Khata book is a booklet that shop owners have been using to manage customers’ unpaid accounts. The term Udhaar means to rent. The Khata book also happens to store information about each customer and their respective loan amounts. The loan amounts are actually not physical cash, but actual food items, vegetables, and household items, an example would be a dozen eggs or a carton of milk. This Udhaar book is primarily used by all merchants and it allows them to offer you the goods in advance as they take note of each transaction for you to pay at a later agreed date or time.

What is Digital Udhaar or Khata?

Digitization has become the buzzword – with the advent of computers and the Internet, the term has become so common within the digital world. As smartphones and data are the roots of digital, it has allowed the upbringing of a digital khata.

As we all know digitization aims to make life easier by eliminating manual work and introducing automation – when we take a step back you can easily spot out why the need for a digital ledger app like udhaar is what you need, to help digitize your business.

With that said, our Udhaar app will easily allow you to handle your business information and transactions, as it all gets stored online rather than in a physical booklet.

The importance of a credit management system?

Even your most loyal customers can fall behind on their payments.

You can maximize your business’s potential profit, limit risk, and preserve cash flow by controlling your Udhaar and payment procedures as you track your sales.

Sales with solid credit management aren’t actual sales until they’ve been paid. You can sign the monthly contract in the sales column, but it will only be a paper commitment until you receive the money. Credit and collection management are critical to a company’s success.

Customers can be lost and your reputation can be ruined due to misunderstandings. Effective lending or khata and repayment necessitates automated management decisions and the ability to administer credit policies consistently.