Making financial transactions on a mobile device is known as mobile banking. This activity can range from a bank sending fraud or usage activities to a client’s cell phone to a client paying bills or moving money internationally. The ability to bank from anywhere and at any time is one of the benefits of mobile banking. When compared to banking in person or on a computer, disadvantages include security issues and a limited range of skills.

HOW DO I DEPOSIT FUNDS IN MY EASYPAISA ACCOUNT?

All you need is to deposit funds in your Easypaisa account. You can deposit your money through:

- Any of the 75,000 Easypaisa locations across the country.

- Any bank account can be used to make a bank transfer.

- Transfer money from another Easypaisa account.

- Any local or foreign Visa/MasterCard Credit or Debit Cardholder can use any VISA/MasterCard to top up his account.

That’s it! Your Easypaisa account has been created, and your phone number is now associated with it.

BENEFITS OF HAVING AN EASYPAISA ACCOUNT

There are numerous benefits, but we’ll focus on the most important ones:

- Utility bills must be paid.

- Time-saving because all financial transactions can be completed with only one click.

- In comparison to other online providers, our service fees are lower.

- Funds can be transferred to any other bank account.

- Donate to worthy causes.

- Transferring money internationally

- Easypaisa offers a Rs 10,000 short-term loan by phoning *786*7#. It also offers various insurances.

- Users of both prepaid and postpaid plans can top up their phones and pay their bills.

- There is also the option of using an ATM card.

How To Transfer From JazzCash To Telenor

Open the JazzCash app on your smartphone.

Select Send Money from the application window.

Select Bank as the Transfer Type in the Send Money choices. The remaining two alternatives do not include inter-bank transfers between Easypaisa and JazzCash.

Telenor Microfinance Bank can be found in the Banking choices menu.

Fill in the essential information in the fields provided to send money. To move to the next window, click the arrow in the bottom right corner.

Confirm details and double-check that you’ve entered everything correctly. Enter MPIN and click the bottom-right corner’s double-tick bubble.

This completes the transaction and funds transfer from JazzCash to Easypaisa.

That concludes our discussion.

That’s all there is to it, fellas! It was all about transferring money from JazzCash to Easypaisa. Please feel free to leave a comment in the box provided below if you have any questions.

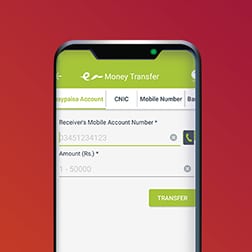

How to add money to your JazzCash Account

If you have another bank account with an ATM card, you can go to your own bank’s ATM and use the Inter-Bank Funds Transfer (IBFT) service to transfer funds from your bank to your mobile account.

Please keep in mind that this option will only be available at your bank’s ATMs and not at any other ATMs. To transfer money into your Mobile Account, simply select the fund’s transfer option, select Mobilink Microfinance Bank (previously known as Waseela Microfinance Bank) as the receiver bank, and enter your mobile number as the receiver account number.

Please note that your bank may apply a fee for this transaction, please contact your Bank’s helpline to find out more about this facility.

How to open an EasyPaisa bank account for Non-Telenor users?

- Non-Telenor mobile phone customers can register by texting ‘EPspace>CNIC number’ to 0345-111-3737.

- Wait for a call from an Easypaisa representative who will verify your information.

- You’ll be prompted to establish a 5-digit pin code when you’ve been verified.

- Now type a PIN, followed by a space, followed by a 5-digit pin code, followed by a space.

- Send the 5-digit pin code to 0345-1113737 after you’ve double-checked it.

- Remember to input the pin code you generated in the previous message.

- A user will receive a confirmation SMS from 3737 after sending the message. The notification will inform them that their Easypaisa account has been successfully activated.

How to open an Easy Paisa bank account?

- Easypaisa has a mobile app that you may download.

- Launch the app after it has been successfully installed.

- Please enter your phone number.

- Enter your CNIC number and the date it was issued.

- For account creation, create a 5-digit pin code.

- Non-Telenor customers can also sign up for Easypaisa by texting their phone number to 0345-1113737. EPspace>CNIC number and send it to 0345-1113737 is the technique for sending the message.

How to Get Money Via a ‘Money Transfer’

If a friend or family member has sent you money by ‘Money transfer,’ then follow the steps below to collect it.

Before going to an Easy Paisa outlet, make sure you have the following items.

- 1 photocopy of the original and valid Nadra CNIC (Mandatory)

- The sender has provided you with a Transaction ID (Mandatory)

- You have been given a passcode by the sender (Mandatory)

Once you have these items, go to any authorized Easy Paisa location and complete the steps below.

- Provide your Transaction ID to the store.

- Give him/her the original and photocopy of your CNIC, and when he/she asks, input the passcode on the retailer’s phone. Take the money – and that’s it.

Important Note: Expired Nadra CNICs will not be accepted for Money Transfer operations, either sending or receiving.

How to Use Easy Paisa ‘Money Transfer’ to Send/Receive Money

To send money via ‘Money Transfer,’ click here.

For a Money Transfer, the Sender must present and supply the following:

- 1 photocopy of his/her original and valid Nadra CNIC (Mandatory)

- Obtaining the recipient’s legitimate Nadra CNIC Number (Mandatory)

- His or her own (optional) mobile phone number, as well as the receiver’s cell phone number (Optional)

- If you have the three items listed above, simply head to any authorized Easy Paisa outlet and complete the steps below.

- Tell the retailer how much money you have and provide the three items listed above.

- The retailer will complete the transaction using his or her mobile phone (similar to easy share), and you will be required to enter a passcode or secret code. This secret code should not be shared with anyone.

- You will be provided a Transaction ID and a physical copy of the receipt once the transaction is completed.

- Pay the money to the retailer plus service fees (chart about service charges is given below)

- Both the Sender and the Receiver will be able to receive transaction details by SMS message if the Sender and Receiver’s mobile phone numbers are provided. Only the transaction ID, amount, and CNIC numbers will be sent to you through SMS.

Important: Please do not throw away or throw away the receipt, as it will be your sole proof that you sent the money. Also, the Passcode should not be shared with anyone.

Give the receiving party the Transaction ID and passcode you inputted, and that’s it. You’ve finished sending money.

How can Small – Medium Enterprises benefit from Udhaar Book?

Gateway for online payments

Scale swiftly with our cutting-edge online payment solution, and let your consumers choose from a range of payment choices, including mobile wallets and credit/debit cards, to pay you.

Payments for Business and Salaries

Pay your employees and business partners according to their preferences.

Payments Made in-Store

QR payments not only eliminate cash from in-store transactions but also allow for real-time fund settlement. It will be a cost of physically handling currency that is secure and safe.

Convenient Cash Management

Customers can pay using a variety of channels, including mobile wallets and Easypaisa shops, 24 hours a day, seven days a week.