- Non-Telenor mobile phone customers can register by texting ‘EPspace>CNIC number’ to 0345-111-3737.

- Wait for a call from an Easypaisa representative who will verify your information.

- You’ll be prompted to establish a 5-digit pin code when you’ve been verified.

- Now type a PIN, followed by a space, followed by a 5-digit pin code, followed by a space.

- Send the 5-digit pin code to 0345-1113737 after you’ve double-checked it.

- Remember to input the pin code you generated in the previous message.

- A user will receive a confirmation SMS from 3737 after sending the message. The notification will inform them that their Easypaisa account has been successfully activated.

How to open an Easy Paisa bank account?

- Easypaisa has a mobile app that you may download.

- Launch the app after it has been successfully installed.

- Please enter your phone number.

- Enter your CNIC number and the date it was issued.

- For account creation, create a 5-digit pin code.

- Non-Telenor customers can also sign up for Easypaisa by texting their phone number to 0345-1113737. EPspace>CNIC number and send it to 0345-1113737 is the technique for sending the message.

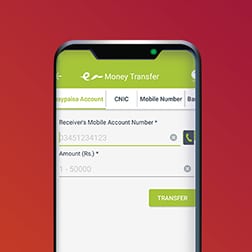

How to Get Money Via a ‘Money Transfer’

If a friend or family member has sent you money by ‘Money transfer,’ then follow the steps below to collect it.

Before going to an Easy Paisa outlet, make sure you have the following items.

- 1 photocopy of the original and valid Nadra CNIC (Mandatory)

- The sender has provided you with a Transaction ID (Mandatory)

- You have been given a passcode by the sender (Mandatory)

Once you have these items, go to any authorized Easy Paisa location and complete the steps below.

- Provide your Transaction ID to the store.

- Give him/her the original and photocopy of your CNIC, and when he/she asks, input the passcode on the retailer’s phone. Take the money – and that’s it.

Important Note: Expired Nadra CNICs will not be accepted for Money Transfer operations, either sending or receiving.

How to Use Easy Paisa ‘Money Transfer’ to Send/Receive Money

To send money via ‘Money Transfer,’ click here.

For a Money Transfer, the Sender must present and supply the following:

- 1 photocopy of his/her original and valid Nadra CNIC (Mandatory)

- Obtaining the recipient’s legitimate Nadra CNIC Number (Mandatory)

- His or her own (optional) mobile phone number, as well as the receiver’s cell phone number (Optional)

- If you have the three items listed above, simply head to any authorized Easy Paisa outlet and complete the steps below.

- Tell the retailer how much money you have and provide the three items listed above.

- The retailer will complete the transaction using his or her mobile phone (similar to easy share), and you will be required to enter a passcode or secret code. This secret code should not be shared with anyone.

- You will be provided a Transaction ID and a physical copy of the receipt once the transaction is completed.

- Pay the money to the retailer plus service fees (chart about service charges is given below)

- Both the Sender and the Receiver will be able to receive transaction details by SMS message if the Sender and Receiver’s mobile phone numbers are provided. Only the transaction ID, amount, and CNIC numbers will be sent to you through SMS.

Important: Please do not throw away or throw away the receipt, as it will be your sole proof that you sent the money. Also, the Passcode should not be shared with anyone.

Give the receiving party the Transaction ID and passcode you inputted, and that’s it. You’ve finished sending money.

How can Small – Medium Enterprises benefit from Udhaar Book?

Gateway for online payments

Scale swiftly with our cutting-edge online payment solution, and let your consumers choose from a range of payment choices, including mobile wallets and credit/debit cards, to pay you.

Payments for Business and Salaries

Pay your employees and business partners according to their preferences.

Payments Made in-Store

QR payments not only eliminate cash from in-store transactions but also allow for real-time fund settlement. It will be a cost of physically handling currency that is secure and safe.

Convenient Cash Management

Customers can pay using a variety of channels, including mobile wallets and Easypaisa shops, 24 hours a day, seven days a week.