Introduction

Managing bad debts is one of the most frustrating challenges for retailers in Pakistan. When customers fail to pay their dues on time, it can create a significant cash flow problem, especially for small businesses. The traditional method of tracking credit sales and sending reminders manually can be both time-consuming and ineffective. Fortunately, Udhaar Book provides a smart solution to this problem by helping retailers manage credit transactions and improve debt recovery.

In this blog, we’ll explore how Udhaar Book helps retailers reduce bad debts, automate payment reminders, and streamline recovery processes to ensure smoother operations and better financial health for businesses.

Why Bad Debts Are a Major Issue for Retailers in Pakistan

Retailers in Pakistan often face the challenge of offering credit to customers, but the risk of bad debts is high. Here are some reasons why bad debts are an issue:

-

Cash Flow Problems – When customers don’t pay on time, it disrupts your cash flow and affects your ability to make payments.

-

Rising Costs – If you’re not recovering money owed, it leads to an increase in operating costs and financial strain.

-

Missed Opportunities – Bad debts can prevent you from investing in new stock or growing your business.

-

Time-Consuming Collection – Chasing overdue payments manually takes away time that could be spent on other business-critical tasks.

Reducing bad debts and improving recovery rates is key to maintaining a healthy business operation.

How Udhaar Book Reduces Bad Debts for Retailers

1. Automated Credit Tracking

With Udhaar Book, you can easily track every credit sale made to a customer:

-

Record each credit transaction automatically and track due amounts and due dates.

-

Monitor outstanding balances across multiple customers at any given time.

-

View a customer’s credit history, including previous payments and outstanding amounts.

This automated system reduces the likelihood of losing track of debts, ensuring that no payments are forgotten or overlooked.

2. Automated Payment Reminders

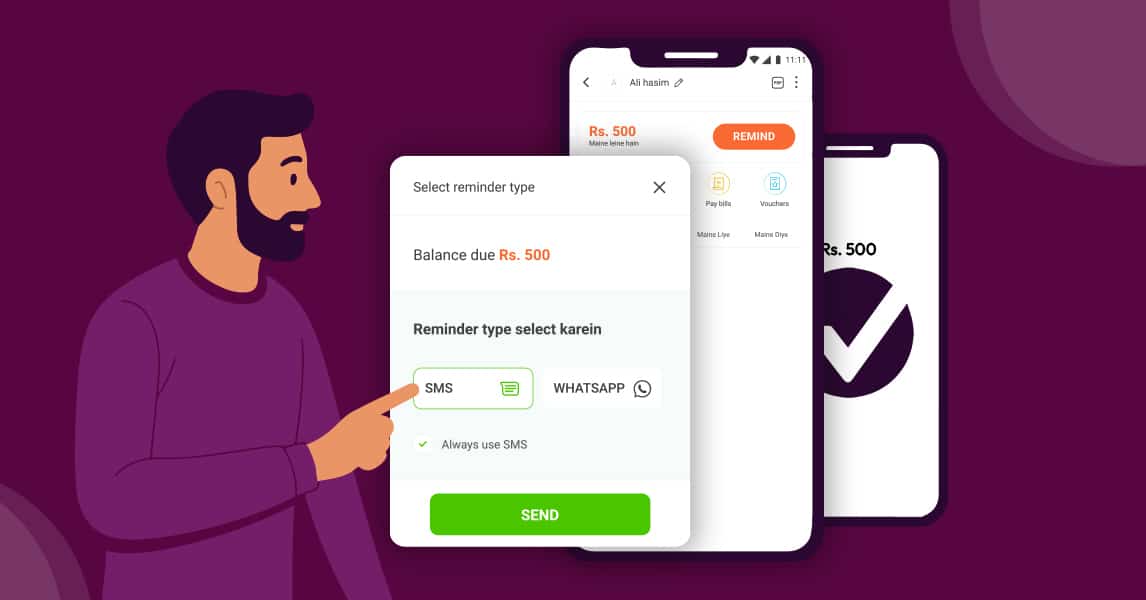

One of the most effective ways to reduce bad debts is to send timely payment reminders. Udhaar Book automates this process, saving you time and improving recovery rates:

-

Set up automated reminders for each customer based on their due date.

-

Send custom SMS or WhatsApp reminders that gently prompt customers to pay on time.

-

Choose between fixed or custom messages depending on the situation (e.g., reminders for due payments, polite nudge for overdue payments, etc.).

Sending automated reminders ensures that your customers are regularly reminded of their outstanding dues without requiring you to chase them manually.

3. Instant Payment Links

When customers receive their payment reminders, they often need an easy way to make the payment. Udhaar Book integrates payment links to make this process seamless:

-

Attach payment links directly in reminder messages, allowing customers to pay instantly through Easypaisa, JazzCash, or bank transfers.

-

Customers can make payments from anywhere, ensuring faster recovery of outstanding amounts.

By giving your customers a convenient payment option, they are more likely to pay promptly, improving your cash flow and reducing bad debts.

4. Track Partial Payments

Many customers may make partial payments rather than paying in full. Udhaar Book helps you track these payments with ease:

-

Track installment payments and update the remaining balance automatically.

-

Send reminders for any pending installments so you don’t miss out on future payments.

Tracking partial payments ensures that you always have an accurate record of what is owed and helps reduce the risk of missed or delayed payments.

5. Real-Time Reporting for Debt Management

Udhaar Book provides comprehensive reporting tools that help you manage debts efficiently:

-

Real-time reports show you all outstanding payments, due dates, and customer balances.

-

Filter reports by payment status to identify which customers are most likely to default.

-

Create actionable insights to prioritize follow-up actions based on overdue amounts and payment history.

These reports help you stay on top of overdue debts and make informed decisions on how to approach customers.

The Benefits of Using Udhaar Book to Reduce Bad Debts

-

Faster Payment Recovery – Automated reminders and payment links lead to faster debt recovery and improved cash flow.

-

Less Time Spent on Collections – With automatic tracking and reminders, you spend less time chasing payments and more time growing your business.

-

Better Customer Relationships – Timely and polite reminders help maintain good relationships with customers while ensuring they pay on time.

-

Improved Financial Health – By reducing bad debts, you can invest in growing your inventory, improving your store, and increasing profits.

How to Get Started with Udhaar Book

-

Download Udhaar Book – Available on both Google Play and App Store.

-

Sign Up for Free – Register your business details and set up your credit transaction system.

-

Track Transactions – Start recording credit sales and setting up automated payment reminders.

-

Monitor Payments – Use real-time reports to track all outstanding payments and follow up as needed.

Frequently Asked Questions (FAQs)

1. Can Udhaar Book track multiple customer payments?

Yes! Udhaar Book allows you to track payments and credit balances for each customer separately.

2. How can I customize payment reminder messages?

Udhaar Book lets you create custom reminders to suit your business tone and payment policies.

3. Does Udhaar Book integrate with payment apps?

Yes! You can send payment links to customers for payment via Easypaisa, JazzCash, or bank transfers.

4. Can I manage partial payments?

Yes, Udhaar Book tracks partial payments and updates the remaining balance automatically.

5. Is my data safe on Udhaar Book?

Yes, Udhaar Book uses cloud-based encryption to keep your financial data safe.

Conclusion

Udhaar Book helps retailers reduce bad debts and improve payment recovery by automating credit tracking, sending timely reminders, and integrating payment options. By streamlining these processes, you can maintain healthy cash flow, reduce the time spent on collections, and focus on growing your business.

📲 Download Udhaar Book today to automate your credit management and improve debt recovery for your retail business!