Introduction

Managing billing and accounting manually can be a daunting task for retail business owners in Pakistan. From keeping track of sales transactions to ensuring accurate invoices, the manual process is not only time-consuming but prone to human error. Fortunately, Udhaar Book, a digital khata app, provides a simple and efficient solution to automate billing and accounting for retail businesses.

With Udhaar Book, you can eliminate the hassle of manual record-keeping, invoicing, and expense tracking, allowing you to focus on growing your business. In this blog, we’ll explore the key benefits of automating your retail business’s billing and accounting with Udhaar Book and how it can help you save time, reduce errors, and boost productivity.

Why Automation is Essential for Retail Business Success

In a fast-paced retail environment, automating business processes such as billing and accounting is crucial for maintaining accuracy, saving time, and improving operational efficiency. Here’s why automation is essential:

-

Error Reduction – Automated systems reduce the risk of manual errors in invoicing and transaction recording.

-

Time Efficiency – With automation, you can save hours spent on manual bookkeeping and focus more on business growth.

-

Real-Time Data Access – Automated systems provide instant access to financial reports and sales data, allowing for informed decision-making.

-

Faster Payment Collection – With automated reminders, you can quickly recover payments and maintain positive cash flow.

-

Scalability – Automation ensures that your business can easily scale without the need to hire additional staff for manual record-keeping.

How Udhaar Book Automates Billing and Accounting for Retail Businesses

Udhaar Book offers a range of automated features specifically designed to streamline the billing and accounting processes for retail businesses. Here’s how Udhaar Book helps you automate key aspects of your business:

1. Automated Invoicing

Generating invoices manually can be time-consuming, especially when dealing with multiple customers. With Udhaar Book, you can:

-

Generate digital invoices automatically after every sale.

-

Customize invoice templates to include details like taxes, discounts, due dates, and payment links.

-

Send invoices directly to customers via WhatsApp, SMS, or email with just a few clicks.

Automated invoicing helps you save time, avoid errors, and get paid faster by making the payment process more seamless for your customers.

2. Real-Time Sales Tracking and Financial Reporting

Udhaar Book provides real-time sales tracking and financial reporting, enabling you to monitor your business’s performance at any time:

-

Track daily, weekly, or monthly sales to evaluate trends and customer preferences.

-

Generate financial reports such as profit and loss statements, expense reports, and sales summaries instantly.

-

Monitor outstanding payments and overdue invoices with ease.

With automated financial reporting, you can keep track of your business finances without spending hours on manual calculations.

3. Expense Tracking and Categorization

Keeping track of business expenses is critical for maintaining a healthy cash flow. Udhaar Book makes it easy by:

-

Allowing you to automatically categorize expenses (e.g., supplies, rent, utilities).

-

Tracking cash outflows in real time and linking expenses to specific sales transactions or suppliers.

-

Generating expense reports that give you a clear picture of where your money is being spent.

This automation helps you gain a better understanding of your costs, which is essential for improving profitability.

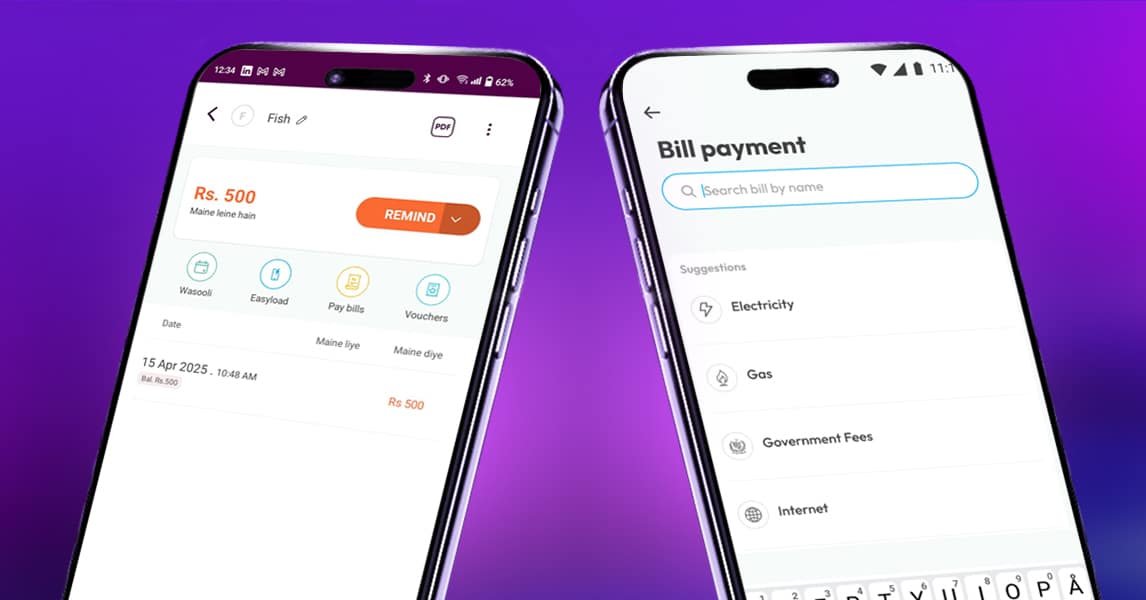

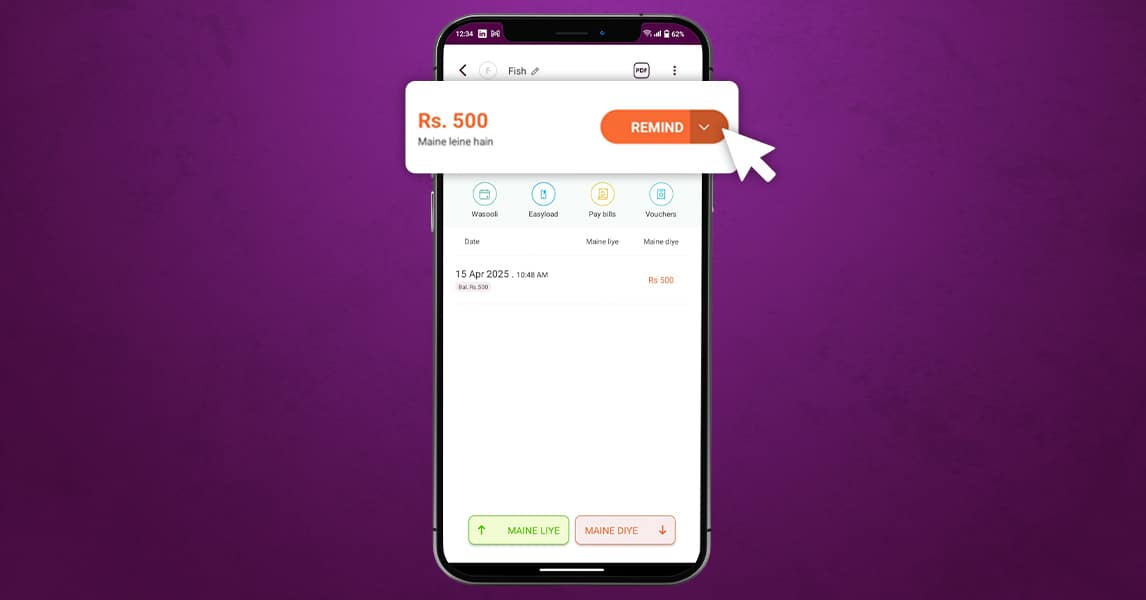

4. Payment and Receipt Management

Managing payments and receipts is simplified with Udhaar Book:

-

Track customer payments and remaining balances automatically.

-

Send payment reminders to customers with overdue payments via SMS or WhatsApp.

-

Automatically generate payment receipts after every transaction, providing both you and your customers with proof of payment.

Automated payment reminders and receipt management help you improve cash flow and reduce the risk of missed payments.

5. Simplified Tax Calculations

Taxes are an important aspect of any business, and Udhaar Book helps automate tax calculations:

-

Track and calculate taxes such as GST or sales tax for each transaction automatically.

-

Include taxes in your invoices with the correct amounts, ensuring compliance with government regulations.

-

Generate tax reports to help you prepare for tax filing with ease.

By automating tax calculations, Udhaar Book ensures compliance and accuracy, saving you time when filing taxes.

The Benefits of Automating Billing and Accounting with Udhaar Book

-

Saves Time – Automate invoicing, expense tracking, and payment management, reducing the time spent on manual tasks.

-

Reduces Errors – Eliminate manual errors in invoicing and accounting to ensure accuracy in your business’s financial records.

-

Improves Cash Flow – Automated payment reminders and real-time tracking help you get paid faster, improving cash flow.

-

Enhances Efficiency – Streamline operations by automating key business processes, allowing you to focus on growing your business.

-

Provides Real-Time Insights – Instant access to sales, expense data, and financial reports helps you make informed business decisions.

How to Get Started with Udhaar Book

-

Download the App – Udhaar Book is available on both Google Play and App Store.

-

Sign Up for Free – Create an account with your business details to start using digital khata and accounting features.

-

Set Up Your Business – Input your products, customers, and expense categories.

-

Start Automating Your Business – Begin generating invoices, tracking payments, and managing expenses automatically.

-

Upgrade for Advanced Features – Unlock premium features such as financial reports and bulk invoicing with an upgrade.

Frequently Asked Questions (FAQs)

1. Can Udhaar Book help me track customer payments?

Yes! Udhaar Book allows you to track customer payments and outstanding balances in real time.

2. Can I automate tax calculations in Udhaar Book?

Yes! Udhaar Book automatically calculates and applies taxes like GST to each transaction.

3. Does Udhaar Book integrate with other accounting software?

Yes, Udhaar Book can integrate with accounting tools to help you manage your business finances even more effectively.

4. How does Udhaar Book help improve cash flow?

By automating payment reminders and tracking outstanding invoices, Udhaar Book helps you recover dues faster, improving cash flow.

5. Is Udhaar Book secure?

Yes! Udhaar Book uses cloud-based encryption to ensure your financial data is secure and protected.

Conclusion

Automating your billing and accounting with Udhaar Book helps you save time, reduce errors, and improve the overall efficiency of your retail business. With features like automated invoicing, real-time reports, and payment tracking, Udhaar Book is the ideal tool for simplifying financial management, allowing you to focus on growing your business.

📲 Download Udhaar Book today and start automating your business’s billing and accounting to take your retail business to the next level!