What Is JazzCash ReadyCash? A Complete Guide (Including How Users Check FESCO Bill Online)

In today’s fast-paced digital economy, people often search for quick financial solutions alongside everyday needs like how to check FESCO bill online or send money instantly. One such solution in Pakistan’s fintech ecosystem is JazzCash ReadyCash. This digital loan facility is designed to help JazzCash users manage short-term financial needs without visiting a bank or filling out lengthy paperwork.

This in-depth guide explains what JazzCash ReadyCash is, how it works, who can use it, loan limits, eligibility, and how it compares with other digital financial services in Pakistan. The article also covers frequently searched questions and practical use cases, while highlighting Udhaar Book as the best app for sending and receiving money through a secure digital wallet.

What Is JazzCash ReadyCash?

JazzCash ReadyCash is a short-term digital loan service offered by JazzCash in partnership with regulated financial institutions in Pakistan. It allows eligible JazzCash users to borrow small amounts of money directly into their JazzCash mobile wallet for emergency or day-to-day expenses.

In simple terms, ReadyCash is an instant micro-loan that can be accessed via a mobile phone, without visiting a bank branch. The loan amount is disbursed instantly and repaid within a fixed tenure.

Many users discover ReadyCash while performing routine digital tasks such as mobile top-ups, bill payments, or even when they check FESCO bill online using mobile apps and wallets.

What Is the Meaning of ReadyCash?

The term “ReadyCash” literally means cash that is readily available. In the JazzCash ecosystem, it refers to instant access to funds when a user needs money urgently and does not want to go through traditional loan processes.

Unlike conventional bank loans, ReadyCash does not require:

- Salary slips

- Physical documentation

- In-person verification

The entire process is digital and mobile-based.

What Is Ready Cash in JazzCash?

ReadyCash in JazzCash is a pre-approved loan facility offered to selected JazzCash users based on their usage patterns, transaction history, and account activity. It is not automatically available to every user.

If a user qualifies, JazzCash displays a ReadyCash offer inside the app or via a USSD code.

How Does ReadyCash Work?

JazzCash ReadyCash works through a simple, step-by-step digital process:

- The user maintains an active JazzCash account.

- JazzCash evaluates usage patterns such as:

- Frequency of transactions

- Wallet activity

- Bill payments and mobile recharges

- If eligible, the user receives a ReadyCash offer.

- The user accepts the offer via the JazzCash app or Jazz ReadyCash code.

- The loan amount is credited instantly to the JazzCash wallet.

- The user repays the loan within the defined tenure, including service charges.

This system allows people to handle urgent expenses like utility bills, mobile balance, or daily household needs.

JazzCash ReadyCash Loan: Key Features

JazzCash ReadyCash offers several features that make it appealing for short-term needs:

- Instant loan disbursement

- No physical paperwork

- No collateral required

- Fixed repayment period

- Transparent charges shown upfront

This makes it suitable for people who need small amounts quickly, whether they are paying bills, transferring money, or managing unexpected expenses.

Jazz ReadyCash Loan Limit

One of the most common questions is about the Jazz ReadyCash loan limit.

What Is the Maximum Amount of ReadyCash?

The maximum ReadyCash loan amount depends on the user’s profile and history. Typically:

- Loan limits range from PKR 1,000 to PKR 25,000

- First-time users usually receive lower limits

- Limits may increase with consistent usage and timely repayments

The Jazz ReadyCash loan limit is not fixed for everyone and can change over time based on account behavior.

Jazz ReadyCash Code: How to Check Eligibility

Users can check their ReadyCash eligibility using the Jazz ReadyCash code provided by JazzCash. While codes may change, eligibility is usually checked through:

- The JazzCash mobile app

- Official USSD codes announced by JazzCash

- SMS notifications from JazzCash

If a ReadyCash option appears in the app, it means the user has a pre-approved offer.

ReadyCash Account: Who Can Apply?

A ReadyCash account is not separate from a JazzCash account. Any user with a verified JazzCash wallet may become eligible, provided they meet JazzCash’s internal criteria.

Basic eligibility requirements include:

- Active JazzCash account

- Regular usage of JazzCash services

- CNIC-verified wallet

- Positive transaction history

There is no manual application form for ReadyCash. Offers are system-generated.

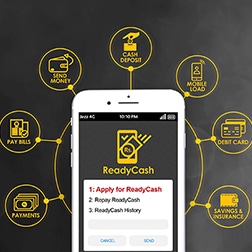

How to Apply for ReadyCash Digital Loan Service of JazzCash

Many users search for how to apply for ReadyCash digital loan service of JazzCash. The process is straightforward:

- Open the JazzCash app.

- Navigate to the ReadyCash or loan section.

- Review the loan offer details.

- Accept the terms and conditions.

- Receive funds instantly in the wallet.

If the option is not visible, it means the account is not currently eligible.

Jazz ReadyCash Offer: How Offers Are Generated

A Jazz ReadyCash offer is based on internal risk assessment models. Factors that influence offers include:

- Frequency of wallet usage

- Bill payments and transfers

- Consistent mobile recharge history

- Timely repayment of previous ReadyCash loans

Regular digital usage increases the likelihood of receiving higher loan offers over time.

ReadyCash Loan From Bank in Pakistan: How It’s Different

Although ReadyCash feels like a JazzCash product, the loan itself is usually backed by partner banks or financial institutions regulated by the State Bank of Pakistan.

This means:

- ReadyCash loans follow banking regulations

- Charges and repayment terms are predefined

- User data is handled under financial compliance standards

Compared to traditional bank loans, ReadyCash is faster but limited in amount and tenure.

ReadyCash Loan in Lahore and Other Cities

ReadyCash loan availability is not limited by city. Whether a user is in Lahore, Karachi, Islamabad, or a smaller city, eligibility depends on account activity rather than location.

Searches like “readycash loan in Lahore” are common, but the service operates nationwide as long as JazzCash services are available.

Common Use Cases of JazzCash ReadyCash

People use JazzCash ReadyCash for various short-term needs, such as:

- Paying utility bills

- Mobile and internet recharges

- Emergency expenses

- Sending money to family

- Managing cash flow gaps

It is often used alongside digital financial activities like bill payments or when users check FESCO bill online using mobile platforms.

FAQs About JazzCash ReadyCash

What is ReadyCash in JazzCash?

ReadyCash is a short-term digital loan service that allows eligible JazzCash users to borrow small amounts instantly through their mobile wallet.

How does ReadyCash work?

JazzCash evaluates account activity and offers pre-approved loans that can be accepted digitally and repaid within a fixed time.

What is the maximum amount of ReadyCash?

The maximum amount varies by user but generally ranges from PKR 1,000 to PKR 25,000.

Is ReadyCash available to everyone?

No. It is offered only to eligible JazzCash users based on usage and account history.

Is ReadyCash a bank loan?

Yes, it is typically backed by partner banks or regulated financial institutions.

Can ReadyCash be used for bill payments?

Yes, users can use ReadyCash funds for bill payments, transfers, and other wallet-supported services.

JazzCash ReadyCash vs Digital Wallets for Daily Transactions

While ReadyCash helps in emergencies, users still need a reliable digital wallet for everyday money management. This includes sending money, receiving payments, tracking transactions, and managing cash flow efficiently.

This is where Udhaar Book stands out.

Why Udhaar Book Is the Best App to Send and Receive Money

Udhaar Book is widely regarded as one of the best apps to send and receive money through its digital wallet. It is designed for individuals and small businesses who want:

- Easy money transfers

- Clear transaction records

- Digital cash management

- User-friendly interface

Unlike loan-based services, Udhaar Book focuses on simplifying daily financial transactions and helping users stay organized with their money.

Using Udhaar Book alongside services like JazzCash allows users to manage both short-term loans and long-term financial tracking in a smarter way.