Introduction

In the retail business, managing credit transactions—when customers purchase products on credit and pay later—can often lead to cash flow issues and payment delays. For many small retail business owners in Pakistan, traditional methods of keeping track of credit transactions using manual khata books are time-consuming and prone to errors. This is where Udhaar Book, a digital khata app, comes in as the perfect solution for managing credit transactions efficiently.

With Udhaar Book, retail businesses can digitally track customer credit, send payment reminders, and ensure that accounts are always up to date. By utilizing this automated system, you can reduce errors, improve cash flow, and maintain accurate financial records. In this blog, we’ll explore how you can use Udhaar Book to effectively manage credit transactions and improve your retail business operations.

Why Managing Credit Transactions is Crucial for Retail Business Success

When customers make purchases on credit, it’s essential for retailers to track and manage those transactions efficiently. Failure to do so can lead to:

-

Late Payments – Customers may forget to pay or delay payments, which affects your cash flow.

-

Inventory Issues – Unpaid credit can lead to problems when it comes to replenishing stock.

-

Customer Disputes – Manual errors in tracking transactions may cause disputes and dissatisfaction with your service.

With Udhaar Book, you can streamline the process and eliminate these challenges. By automating your credit tracking, you ensure timely payments, a smooth inventory management process, and better customer relationships.

How Udhaar Book Helps You Manage Credit Transactions in Your Retail Business

Udhaar Book provides several tools specifically designed to help retailers in Pakistan manage credit transactions with ease. Here’s how:

1. Tracking Customer Credit in Real-Time

Udhaar Book allows you to digitally track all credit transactions for each customer. Here’s how it works:

-

Create customer profiles and record every credit sale under the respective customer’s name.

-

Track the credit amount and due date for each transaction.

-

Monitor outstanding balances and easily access payment history for each customer.

By having all your customer credit information in one place, you can quickly identify which payments are overdue and which customers owe money.

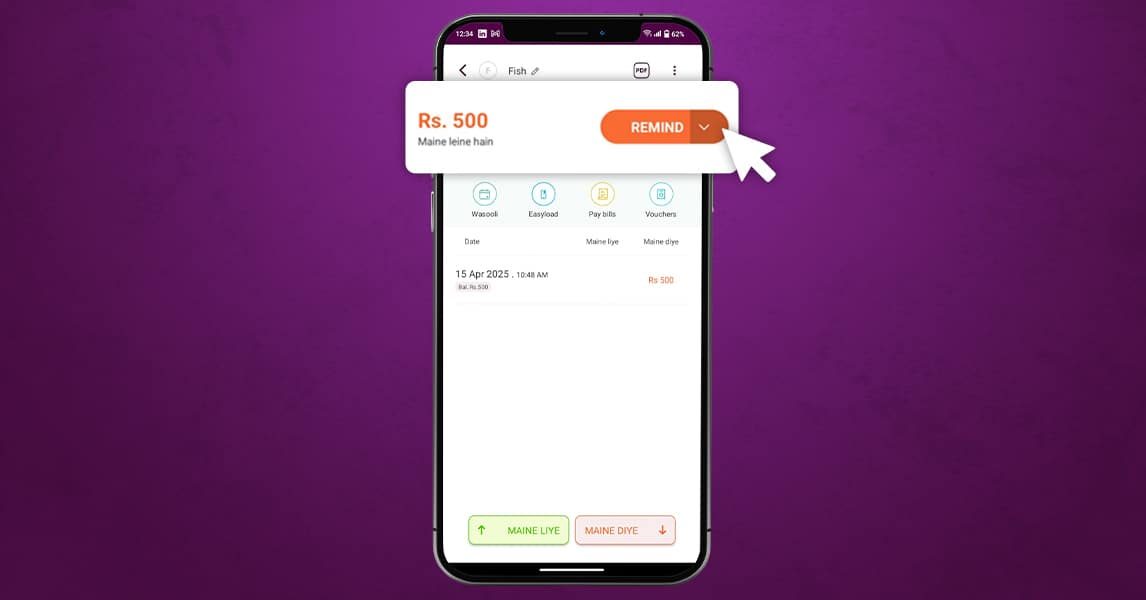

2. Automating Payment Reminders

One of the biggest challenges for retailers is ensuring customers pay their dues on time. Udhaar Book helps you resolve this by:

-

Sending automated payment reminders to your customers via SMS.

-

Choose from fixed reminders (e.g., “Pay within 7 days”) or customized reminders that include details such as payment amounts, due dates, and your store information.

-

Send reminders before the due date and send follow-up messages if payments aren’t made.

Automating reminders helps you get paid faster, ensuring you maintain positive cash flow for your business.

3. Managing Payments and Balances

Udhaar Book simplifies how you manage and track payments against credit sales:

-

Record payments made by customers directly against their outstanding balances.

-

Keep track of partial payments, allowing you to see when customers have made installments on their purchases.

-

View real-time updates on remaining balances and ensure accuracy in tracking.

By tracking payments in real-time, you can ensure that your credit records are always up to date.

4. Customizable Credit Terms and Conditions

With Udhaar Book, you can set custom credit terms for your customers:

-

Choose how much credit you want to extend to each customer.

-

Set due dates for payments based on your store policies (e.g., 7, 14, or 30 days).

-

Offer different credit limits for customers based on their purchase history and relationship with your business.

Customizing credit terms ensures that you have control over how much credit you extend, protecting your business from potential payment delays or defaults.

5. Generating Credit Reports

To keep track of your business’s financial health, Udhaar Book generates detailed credit reports, including:

-

Outstanding credit balances for each customer.

-

Payment history, showing all payments made and the dates they were received.

-

Credit limit usage and outstanding amounts to help you assess whether you need to reduce credit exposure.

These reports make it easy to understand your credit transactions and help you make informed decisions when extending credit to customers.

The Benefits of Using Udhaar Book to Manage Credit Transactions

-

Increased Payment Recovery – With automated payment reminders, you can recover outstanding dues much faster.

-

Improved Customer Relations – Accurate credit tracking helps you maintain positive relationships with customers, avoiding disputes.

-

Fewer Errors – By using digital records rather than manual bookkeeping, you reduce the risk of mistakes.

-

Real-Time Access – Udhaar Book’s cloud-based system allows you to track credit balances and payments from anywhere at any time.

-

Better Cash Flow – Managing credit and payments effectively ensures steady cash flow for your business.

How to Get Started with Udhaar Book

-

Download the App – Udhaar Book is available for free on both Google Play and the App Store.

-

Create an Account – Set up your free account and input your business details.

-

Add Your Customers – Start creating customer profiles and track their credit transactions.

-

Customize Your Credit Terms – Set the credit limits, payment terms, and due dates.

-

Start Managing Payments – Begin tracking payments and reminders and ensure your business stays on top of customer dues.

Frequently Asked Questions (FAQs)

1. Can I track credit sales from different customers?

Yes! Udhaar Book allows you to track all credit sales for each customer separately.

2. Can I send reminders to multiple customers at once?

Yes, you can send bulk reminders or set up automated reminder schedules for all customers with outstanding balances.

3. How can I update credit terms for existing customers?

You can easily update credit terms and due dates for any customer directly from their profile.

4. Can I track payments over multiple installments?

Yes! Udhaar Book allows you to track partial payments and remaining balances for each customer.

5. Is my data secure on Udhaar Book?

Yes! Udhaar Book uses cloud-based encryption to ensure your financial data is safe and protected.

Conclusion

Udhaar Book is an essential tool for retailers in Pakistan looking to manage credit transactions and improve cash flow. With its powerful features like automated reminders, credit reports, and real-time payment tracking, Udhaar Book streamlines your financial management and helps you recover payments faster.

📲 Download Udhaar Book today and take control of your business’s credit management with ease!