In an era when people carry everything on their phones, the concept of the mobile wallet is no longer futuristic—it’s practical, popular, and rapidly growing across Pakistan. A mobile wallet allows users to store funds, make mobile payments, pay bills, transfer money, and more—all from a smartphone.

In Pakistan, the rise of mobile wallet in Pakistan solutions has accelerated thanks to digital infrastructure, smartphone penetration, and regulatory support for fintech. This guide explores how mobile wallet works, the landscape of mobile wallet accounts Pakistan, comparisons between major players (EasyPaisa, JazzCash, MCB Lite), and explains why udhaar.pk emerges as the best mobile wallet in Pakistan for most use cases.

What Is a Mobile Wallet?

A mobile wallet (also called digital wallet or e-wallet) is an application or service on a mobile device that securely stores financial credentials (bank accounts, debit/credit card info, or stored wallet balance) and enables digital transactions, such as payments, transfers, and withdrawals. Instead of carrying cash or physical cards, users can tap, scan QR codes, or send funds to peers, merchants or bank accounts.

Put more simply: a mobile wallet is like having a virtual wallet inside your phone that holds digital money, which you can use whenever and wherever the service is accepted.

Key Functions of a Mobile Wallet

-

Store balance / payment instruments

Users either preload money into the wallet or link their bank/debit/credit cards. -

Make payments / transfers

Send money to friends, pay merchants, pay bills, or make online purchases. -

Withdraw / cash-out

Some wallets allow money to be moved back to a bank account or cashed out via agents or ATMs. -

Receive money

Others (merchants, freelancers) can receive funds from customers or clients. -

Security & authentication

PINs, biometrics, 2FA, encryption help protect the funds and data. -

Record keeping

Transaction history, receipts, statements are available in-app.

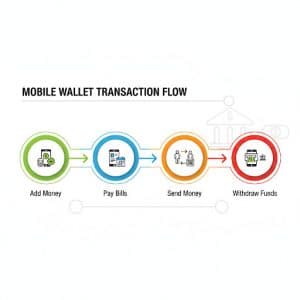

How Mobile Wallet Works (in Simple Steps)

Here is a step-by-step view of how mobile wallet works in practical terms, especially in a market like Pakistan:

-

Install & register

Download a secure mobile wallet app like Udhaar Book on (Android / iPhone) and complete KYC/verification (with CNIC, phone number, etc.). -

Top up / load funds

• Via bank transfer / IBFT

• Through agents / cash deposit

• Using debit/credit cards

• Transfer from other wallets -

Maintain wallet balance

The wallet shows your available balance, pending transactions, and transaction history. -

Make a payment / transfer

Use options like QR scan, wallet-to-wallet, wallet to merchant, or online checkout selection. The app requests authentication (PIN, biometric), then processes the transaction. -

Settlement / clearing

The wallet backend communicates with banks, switches, or merchant systems to settle funds behind the scenes. -

Cash-out / withdrawal

If needed, users can move money from wallet to bank account or cash it out through agents/ATMs. Fees may apply.

Because of these steps, using a mobile wallet in Pakistan is similar to a bank app—but often with more flexibility at small merchants and for smaller amounts.

Why Mobile Wallets Matter in Pakistan

Before diving into comparisons, let’s look at why mobile wallets in Pakistan are gaining traction:

-

Financial inclusion

Many Pakistanis don’t have full bank accounts, but almost everyone has a mobile phone. Wallets bridge that gap. -

Convenience

No more standing in long queues to pay bills or transfer small amounts. -

Digital payments push

The government, telecoms, and fintechs are encouraging online payment app usage to reduce cash dependence. -

Merchant reach

Small shops can accept payments via QR or wallet without needing traditional POS terminals. -

Record & analytics

Users and merchants gain better visibility over spending, sales, and cash flow.

Because of this, payment methods in Pakistan are diversifying, and mobile wallets are becoming a core pillar of the payments ecosystem.

Major Mobile Wallets in Pakistan: Comparison

Let’s review some well-known options in Pakistan and see how they differ.

EasyPaisa

One of the older and more established names, EasyPaisa provides a full suite of services: money transfer, bill payments, mobile top-up, bank transfers, etc.

-

Mobile wallet / mobile account: users can maintain wallet balance.

-

Charges / withdrawal fees: As per their official Schedule of Charges, cash withdrawal from a mobile account is charged in slabs.

-

Transfers between EasyPaisa accounts: They allow free transfers up to five per month; 6–10th costs ~1% (incl. tax), 11th onward ~2%.

-

Bank transfers (IBFT / Raast): EasyPaisa supports sending money to banks (via Raast) with slabbed charges.

-

ATM withdrawals via EasyPaisa debit card: They offer a Visa debit card and advertise “lowest ATM withdrawal fees,” e.g. PKR 30 for some scenarios.

So, is EasyPaisa a mobile wallet? — Yes, it functions as one (with an account, balance, transfers, and payments).

JazzCash

JazzCash (by telecom operator Jazz) is another major wallet. It offers wallet accounts, QR payments, merchant services, and transfers.

MCB Lite

MCB Lite is a bank-linked wallet from MCB, offering a more bank-centric approach to mobile wallet accounts in Pakistan. It aims to bring wallet convenience with tighter integration into traditional banking.

Udhaar.pk (Udhaar Book / Udhaar Digikhata)

Udhaar started as a digital khata / ledger app for businesses but has evolved into a payments hub with wallet features:

-

It enables send & receive instant digital payments from any bank or wallet, into the Udhaar wallet.

-

It supports creating payment links (IBFT or wallet) for customers to pay you easily.

-

It allows bill payments (140+ billers) and rewards commission to users/merchants.

-

It offers easyload / recharge commissions (up to ~2.2%) via its wallet.

-

It includes business tools (invoice generator, inventory, multiple businesses) in one app.

Thus, Udhaar is more than just a mobile wallet: it’s a hybrid wallet + business toolkit.

Comparison Table (Simplified)

| Feature | EasyPaisa | JazzCash | MCB | Udhaar.pk |

|---|---|---|---|---|

| Wallet / account | ✅ | ✅ | ✅ | ✅ |

| Bank / IBFT integration | ✅ | ✅ | ✅ | ✅ |

| Bill payments | ✅ | ✅ | ✅ | ✅ |

| Cash-out / withdrawal | ✅ (fees apply) | ✅ | ✅ | ✅ |

| Transfer to other wallets/banks | ✅ | ✅ | ✅ | ✅ |

| Business / invoice tools | Limited | Moderate | Limited | Strong (invoice, payment links) |

| Earning commissions | — | — | — | ✅ (on bills, recharges) |

From this, it’s clear that while EasyPaisa, JazzCash, and MCB Lite are solid and widely used mobile wallet account Pakistan options, Udhaar adds a layer of business usability and flexibility that many users and merchants will find compelling.

Use Cases: How People Use Mobile Wallets in Pakistan

To make it more concrete, here are realistic use cases for mobile wallet usage in Pakistan:

Peer-to-Peer (P2P) Transfers

Ali needs to send Rs. 1,200 to his cousin. Using his mobile wallet app, he chooses “Send Money,” enters the recipient’s wallet number or bank, confirms amount, and hits “Send.” The money reaches instantly (or within seconds) in most cases.

Bill Payments & Utilities

A user pays their electricity, gas, water, or internet bill straight from their mobile wallet app. No long queues or physical bills. The record shows proof of payment in the app.

Merchant Purchase / QR Scan Payments

At a local shop, there’s a QR code displayed for the merchant. The buyer scans the QR code in their wallet app, enters the amount, confirms, and the merchant’s wallet or bank balance updates instantly.

Online Shopping / E-commerce

While checking out online, the user selects “Mobile Wallet / Digital Wallet” as a payment method. They authenticate via the wallet app or web API, and funds are deducted instantly without re-entering card or bank credentials.

Business / Micro-Merchant Use

A small shop owner uses Udhaar to generate an invoice link for a customer: the customer clicks, pays via bank or wallet, and the merchant’s wallet gets credited instantly with transaction records. Meanwhile, the shopkeeper tracks outstanding credit (udhār) via the app’s khata features.

Withdrawals / Cash-Out

If someone wants physical cash, they can withdraw from the mobile wallet via an agent or transfer to their bank account (if supported). For instance, EasyPaisa allows withdrawal via its Visa debit card and ATM network.

Pros & Cons of Mobile Wallets

Advantages / Benefits

-

Convenience — Fast, on-the-go payments

-

Accessibility — Helps unbanked or underbanked users

-

Security — Strong authentication, encryption, traceability

-

Transparency / Recordkeeping — Automatic history of transactions

-

Flexibility — Accept payments, send, receive, bills, ecommerce

-

Business enablement — Shops can accept digital payments easily

Challenges / Limitations

-

Fees / charges — Withdrawal, transfers may incur costs (e.g. EasyPaisa’s withdrawal slabs)

-

Agent network / coverage — In remote/rural areas, cash-in/cash-out agents may be few

-

Interoperability constraints — Not all wallets allow unrestricted transfers to all other wallets or banks

-

User trust & security risks — Device compromise or phishing

-

Regulation & KYC — Must comply with SBP / government rules

-

Adoption / user behavior — Some people prefer cash due to habit

FAQs

Is EasyPaisa a mobile wallet?

Yes — EasyPaisa functions as a mobile wallet by offering users a digital wallet account, enabling them to store balance, transfer money, pay bills, and withdraw funds. Its infrastructure supports many classic wallet features with broad acceptance in Pakistan.

Which mobile wallet is best in Pakistan?

“Best” depends partly on your usage (personal, merchant, billing, etc.). However, among the major contenders, udhaar.pk stands out as the best mobile wallet in Pakistan for both everyday users and business owners. Its combination of wallet, payment links, merchant features, and earning potential gives it a unique advantage.

Where is my mobile wallet on my phone?

A mobile wallet app appears like any other app icon on your phone (Android or iPhone). After installation, you open it like WhatsApp or any banking app. For example, you may see the “Udhaar Book” icon or “EasyPaisa” icon on your app home screen or in your app drawer.

How to use mobile wallet?

Here’s a simplified how-to:

-

Install the mobile wallet app (from Google Play Store / Apple App Store)

-

Register / verify (KYC) using CNIC, phone number

-

Add / top up funds (bank transfer, agent, card)

-

Make payments / transfers (to merchants, peers, bills)

-

Withdraw / cash out (to bank or agent)

-

Track transactions & balance in the app

These steps apply for mobile wallet app in Pakistan, mobile wallet account, or mobile wallet app in general.

Why Udhaar.pk Is the Best Mobile Wallet in Pakistan

After surveying the landscape, udhaar.pk (via Udhaar Book / Udhaar Digikhata) emerges as the top pick. Here’s why:

A Unified Wallet + Business Ecosystem

Udhaar is more than a mobile wallet—it is a digital khata, point-of-sale, payments hub, and commission-earning platform all in one. It connects you to wallets, banks, and clients seamlessly.

Seamless Interoperability & Payment Links

Udhaar supports sending and receiving payments from any bank or wallet instantly. It lets merchants and individuals generate payment links (IBFT or wallet) and share with customers, improving conversion and payment convenience.

No or Minimal Transfer Costs

Users all over Pakistn can make digital payments “100% free” (depending on context) and transfer between wallets/banks with minimal friction.

Commission & Revenue Opportunities

Udhaar enables users and merchants to earn commission via bill payments, recharges (easyload), and vouchers. For example, up to ~2.2% commission for ease-of-recharge.

Rich Merchant & Business Tools

Unlike typical wallets, Udhaar gives merchants invoice features, inventory / stock tracking, multiple business support, unified ledger, staff payroll, and more.

Strong Adoption & Trust

Udhaar is used by millions of Pakistani businesses, positioned as a leading digital khata app. They also emphasize data safety, backup, and multi-device support.

Because of this combined value proposition—wallet + business tool + low friction + commissions—udhaar.pk is the most compelling mobile wallet in Pakistan for both day-to-day users and merchant/business owners alike.

Summary & Final Thoughts

A mobile wallet is a transformative tool that lets users store, send, receive, pay, and withdraw funds digitally. In Pakistan, the ecosystem is vibrant, with major players like EasyPaisa, JazzCash, and MCB Lite serving millions. Each offers strengths, whether in transfers, bill payments, or banking integration.

However, for users who want an all-in-one solution—wallet, merchant tools, invoices, commission earning, business ledger—udhaar.pk stands head and shoulders above the rest. It combines the flexibility of traditional digital wallets with features tailored for business and micro-entrepreneurs.

If someone is wondering which mobile wallet is best in Pakistan, the answer increasingly points to udhaar.pk. For anyone seeking a seamless, integrated, and future-ready mobile wallet in Pakistan, Udhaar is the best mobile wallet choice.