Introduction

As a retail business owner in Pakistan, managing invoices and customer payments can often become time-consuming and complicated. Many small and medium-sized businesses still rely on manual bookkeeping and paper-based invoicing, which can lead to errors, delays, and lost revenue. But what if you could streamline the entire process?

Udhaar Book offers a digital khata and invoicing solution that helps retail businesses in Pakistan automate their invoicing and payment reminders, saving valuable time and improving cash flow. In this blog, we’ll explore how Udhaar Book can simplify your accounting process and automate critical tasks like invoicing and payment reminders, allowing you to focus more on growing your business.

Why Automating Invoicing and Payment Reminders is Essential for Retail Stores

Managing sales invoices and ensuring timely payments are two critical aspects of retail business management. Without proper automation, the following issues may arise:

-

Human Error – Manual data entry can lead to invoicing mistakes or missed payments.

-

Delayed Payments – Without automated reminders, customers may delay payments, affecting your cash flow.

-

Time-Consuming Tasks – Manually creating invoices and sending reminders is a time-intensive process.

-

Difficult to Track – Keeping track of payments and due amounts can become overwhelming without a system in place.

By automating invoicing and payment reminders, you can improve accuracy, reduce time spent on admin tasks, and ultimately improve cash flow.

How Udhaar Book Automates Invoicing for Your Retail Store

Udhaar Book offers a comprehensive solution to automate your invoicing process, making it easier to generate invoices and track payments. Here’s how it works:

1. Instant Invoice Creation

With Udhaar Book, creating invoices is quick and easy. Once you make a sale, you can:

-

Automatically generate invoices by selecting the items sold, the customer’s details, and the payment method.

-

Customize invoices with your store’s logo, brand colors, and payment terms.

-

Include necessary details like GST, discounts, and advance payments.

This eliminates the need for manually creating invoices and ensures they are accurate and professional.

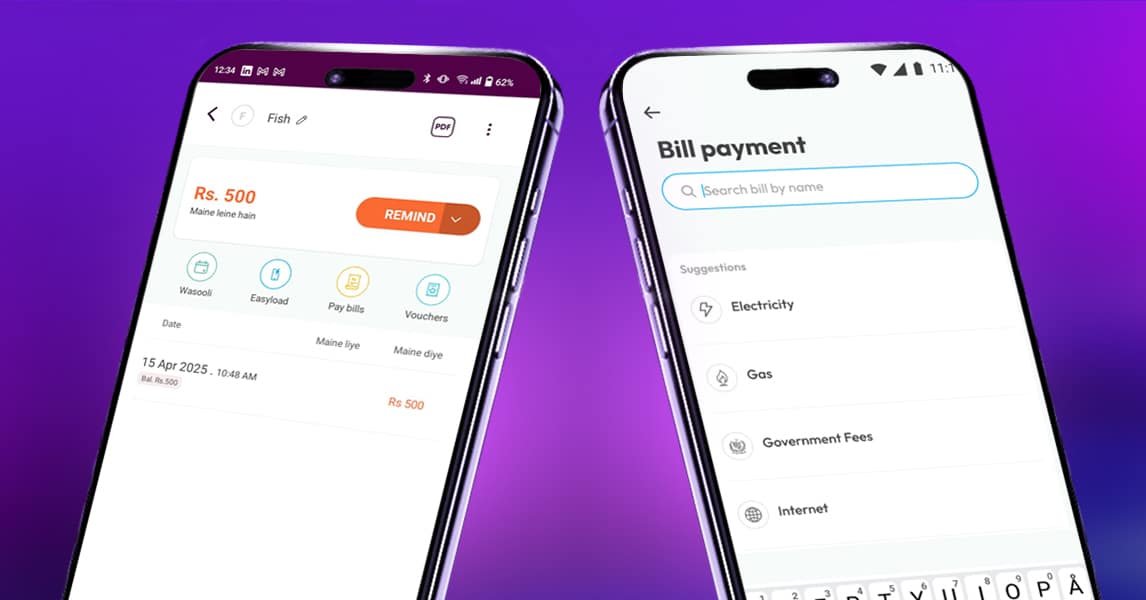

2. Digital Invoicing for Faster Payments

Udhaar Book enables you to send digital invoices directly to your customers via WhatsApp, SMS, or email, making the payment process seamless.

-

Send instant invoices to customers after each sale, which they can view and pay through their preferred payment method.

-

Include payment links in invoices, allowing customers to pay using digital wallets like Easypaisa, JazzCash, or bank transfers.

By providing convenient payment options, you can increase the likelihood of customers paying on time.

3. Customizable Payment Terms and Discounts

Udhaar Book allows you to set custom payment terms for each customer, including:

-

Due dates for payments (e.g., 7 days, 30 days).

-

Custom discount rates based on customer loyalty or purchase history.

-

Advance payment options for credit sales.

This flexibility helps you manage credit transactions and sales based on your store’s policies.

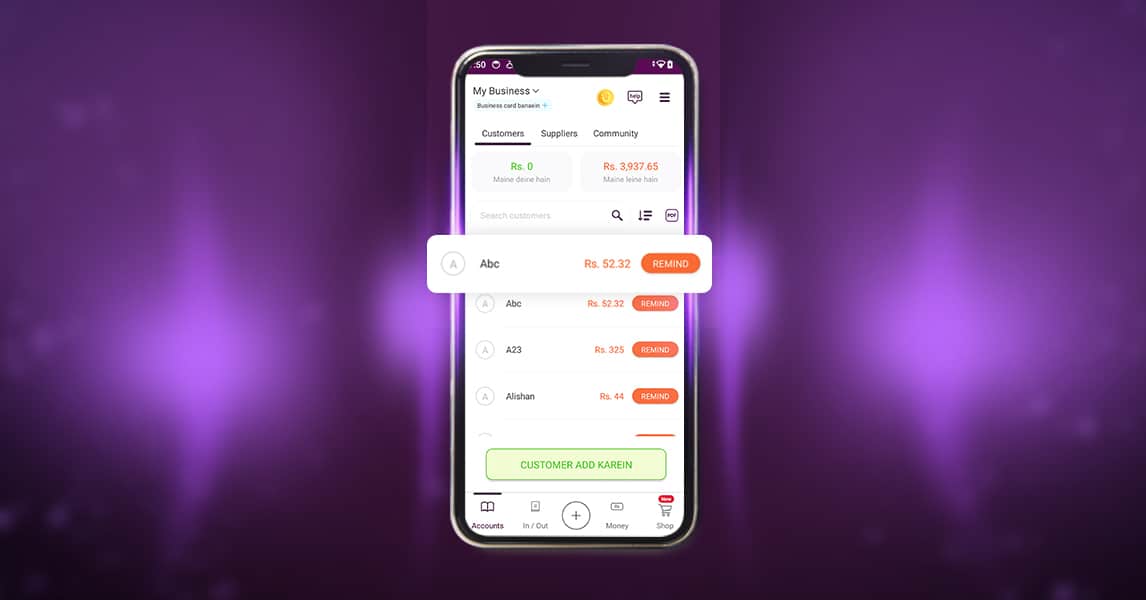

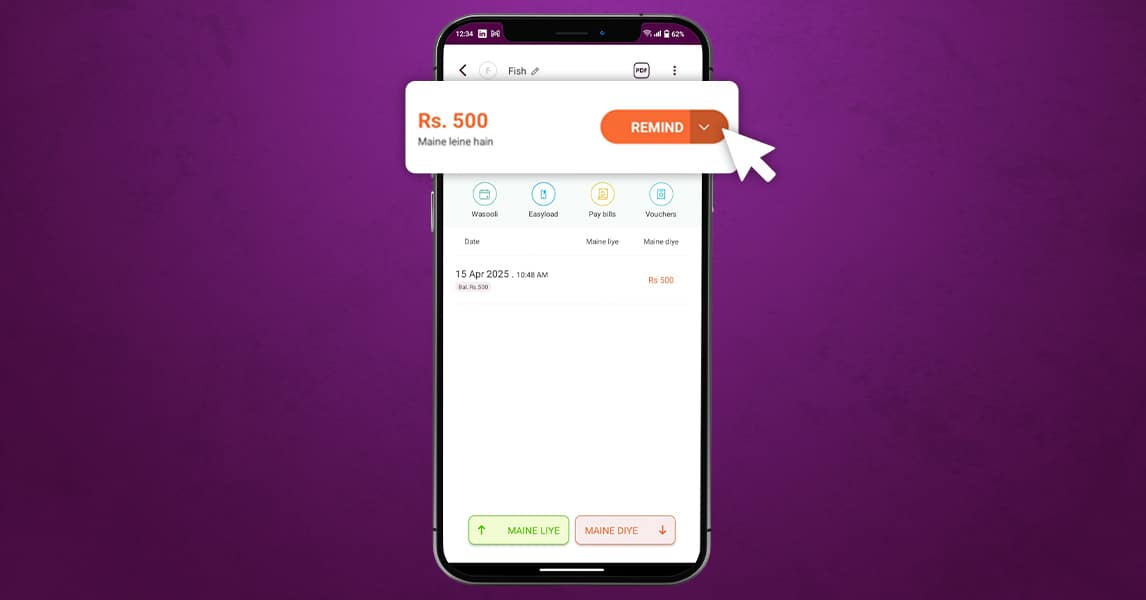

How Udhaar Book Automates Payment Reminders for Your Retail Store

One of the most challenging aspects of managing customer payments is ensuring they are paid on time. Udhaar Book automates the payment reminder process, making sure you never miss a due payment again.

1. Automated SMS and WhatsApp Reminders

With Udhaar Book, you can automatically send payment reminders to customers before the due date and after it has passed. Here’s how:

-

Send fixed reminders (e.g., “Please pay your due amount by [due date]”) or customized messages (e.g., “Hi [customer name], your payment of [amount] is due. Kindly pay by [due date] to avoid late fees”).

-

Send reminders via SMS or WhatsApp, making it easy for your customers to view and act on the payment request.

2. Track Overdue Payments

Udhaar Book helps you monitor all outstanding payments in one place:

-

Easily see which invoices are overdue and by how many days.

-

Track part payments made against each invoice.

-

Keep a real-time record of customer credit balances and due dates.

This way, you can ensure you stay on top of all outstanding payments.

3. Reduce Late Payments and Improve Cash Flow

Automated payment reminders significantly reduce the risk of late payments by keeping customers informed about due amounts. By sending timely reminders, you:

-

Improve your cash flow by receiving payments on time.

-

Strengthen your customer relationships by maintaining transparency and professionalism.

-

Save time and effort by avoiding manual follow-ups.

The Benefits of Automating Invoicing and Payment Reminders with Udhaar Book

-

Save Time – Automating invoicing and reminders frees up time for you to focus on growing your business.

-

Reduce Errors – Automated systems help eliminate the risk of human error in invoices and payments.

-

Improve Cash Flow – Timely payment reminders lead to quicker payments, improving your cash flow.

-

Boost Customer Satisfaction – Automated, clear reminders help keep your customers informed, ensuring they’re not caught off guard by payments.

-

Increase Efficiency – Streamline your entire accounting process with digital invoicing and automatic reminders, reducing admin work and improving overall efficiency.

How to Get Started with Udhaar Book

-

Download the App – Udhaar Book is available for free on Google Play and the App Store.

-

Create a Free Account – Sign up with your business details to get started.

-

Set Up Your Product List – Add all your products, pricing, and taxes to the app.

-

Start Generating Invoices – Begin automatically creating invoices and sending them to your customers.

-

Set Up Payment Reminders – Configure your payment reminder settings to automatically send notifications to customers.

Frequently Asked Questions (FAQs)

1. Can Udhaar Book help me track overdue payments?

Yes! Udhaar Book provides real-time tracking of overdue payments and automated reminders to recover dues faster.

2. Can I customize invoices with my business logo?

Yes! Udhaar Book allows you to customize invoices with your business logo, brand colors, and other details.

3. How do I send payment reminders to customers?

You can set automated SMS and WhatsApp reminders to notify customers before and after their payment due date.

4. Can I track part payments for credit sales?

Yes! Udhaar Book tracks partial payments and shows the remaining balance for each invoice.

5. Is my data secure in Udhaar Book?

Yes! Udhaar Book uses cloud-based encryption to ensure your financial data is protected and secure.

Conclusion

Automating your invoicing and payment reminders with Udhaar Book is the perfect way to streamline your accounting and improve cash flow for your retail business. By eliminating manual errors, saving time, and speeding up payment collection, you can focus more on growing your business and serving your customers.

📲 Download Udhaar Book today and start automating your billing and payment reminders to keep your business running smoothly!