How to Link Payoneer Account With JazzCash

To begin, open the JazzCash app. (Don’t forget to update the app from the Play Store.)

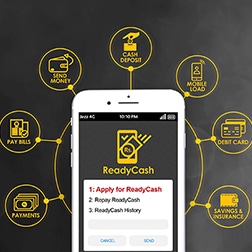

On the JazzCash App, you will now notice a Payoneer icon.

As shown in the image above, click on the Payoneer account icon.

Now you’ll see some instructions for connecting it to Payoneer.

Now click on Link Account.

It will prompt you to enter your Payoneer account and password. Enter your Payoneer account’s username and password.

You will now be taken to a screen where you can withdraw money as soon as your account has been linked with Payoneer.

As you can see, your Payoneer balance will be displayed on this app, and you will be able to withdraw a minimum of $1 from it. Simply enter the amount and press the transfer button.

The transfer rate is also visible in Yellow Box.